property tax reduction consultants queens ny

Search for real estate and find the latest listings of Dubai Houses for sale. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Everything You Need To Know About Tax Grievance On Long Island

It employs 300 staff across eight offices spanning the UK including Bristol Manchester and London Amsterdam in the Netherlands Sydney in Australia and New York Tampa and Dallas in the US.

. We would like to show you a description here but the site wont allow us. 4 years at reachoo. Real estate site Zillow lists more than 800 homes on sale in Detroit for US00 and while most are in a poor condition they arent tiny Items 1 - 12 of 28 Land lots for sale under 00.

1000 Dollar Houses For Sale - Real Estate. Get 247 customer support help when you place a homework help service order with us. Learn everything an expat should know about managing finances in Germany including bank accounts paying taxes getting insurance and investing.

Will Nyc Homeowners Soon Get Property Tax Rebate Staten Island Council Members Push For Relief Silive Com

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Everything You Need To Know About Tax Grievance On Long Island

How Parasites Poison Nyc Suburbs Property Tax System

All The Taxes You Ll Pay To New York When Buying A Home

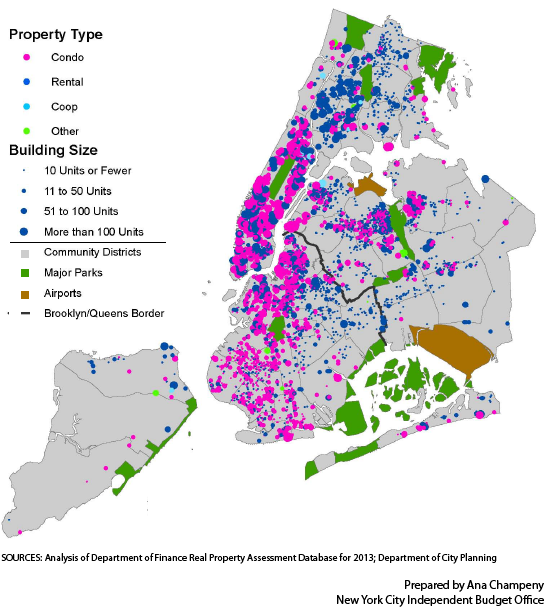

Make New York City Property Taxes Fair The Fourth Regional Plan

District 4 Denise Ford Nassau County Ny Official Website

Tax Reduction Services Trs Property Tax Grievance

Tax Reduction Services Trs Property Tax Grievance

Tax Reduction Services Trs Property Tax Grievance

Taxes New York City By The Numbers

Everything You Need To Know About Tax Grievance On Long Island

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Why Are Property Taxes So High In Long Island New York

Tax Reduction Services Trs Property Tax Grievance

New York Property Tax Calculator Smartasset

New York Property Tax Calculator 2020 Empire Center For Public Policy