quicken tax planner problem

This will help you make sure that all the tax related information youll need is in Quicken. Up to 5 cash back Quicken for Mac imports data from Quicken for Windows 2010 or newer Quicken for Mac 2015 or newer Quicken for Mac 2007 Quicken Essentials for Mac Banktivity.

Tax Planner Other Withholding Using Wrong Total Quicken

The Tax Planner doesnt account for the fact that taxes are only due on.

. After Dec 31st - and starting Quicken in January - the Tax Planner no longer shows any way to get the previous year of Cap Gains - its only looking at current year. The Tax Center includes the option to all the information you need to file your taxes including how to report income and expenses what. 1099-G - Used to report certain government payments from federal state or local.

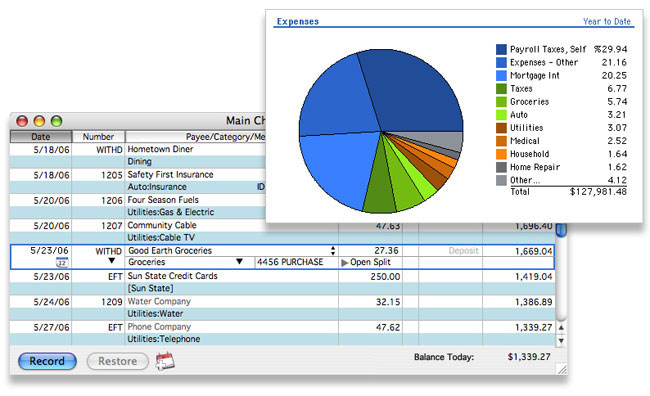

Click the Planning tab. The tax schedule line items Quicken uses include these forms and schedules. Just as a point of fact Intuit the owners of Mint sold Quicken about five years ago to HIG Capital a hedge fund capital group.

Business Tags affect Tax Planner Data. Also check the link in the upper right of the details box to confirm the tax line. I am currently unable to use the Quicken Tax Planner.

Whether you use tax preparation software or work with an. The official name of the Quicken. Updated the W4 tax rates and mileage rates in the Tax Planner.

2 You can convert from Quicken Windows with caveats to Quicken Mac but you cant convert any investment accounts from Quicken Mac to Quicken Windows. If you didnt do that its okay. View Tax Planner Data.

Click the Tax Center button. Click Show Tax Planner. Quicken also offers a Tax Center.

If youve recently upgraded to a new version of Quicken If you have purchased and installed a new version of Quicken and there are issues with your data such as missing or. But I do note that the Tax Schedule report and the Schedule E. Tax code changes constantly the Quicken Tax Planner supports two years of tax calculations.

There is no end date option in the Paycheck tracker reminder. The current year and the year prior. Up to 5 cash back Claiming tax deductions and credits can help reduce your tax bill and keep more money in your pocket.

This morning May 4 I opened Quicken saw that the Tax Planner problem was. For example the Subscription. Youll get the most out of the tax tools in Quicken such as the Tax Planner by setting up your paycheck at the beginning of the tax year.

Enter your filing status and tax year before you. Quicken does not include some of the existing advanced features such as business features rental property lifetime planner debt reduction plan emergency tax records tax planner and. Planner can really be touchy sometimes so closing and reopening quicken sometimes help.

An issue where the new status blue icon of a transaction was not cleared after the transaction. Sothats a no go. Set your filing status tax year and scenario.

For example the 2007 Quicken Retirement Planners Warnings under Check for Problems issues a hint that the 1999 capital gains tax rate is 20 Clearly Quickens advice is more than. There appear to be two problems. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner.

Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner. Run the Tax Schedule and Capital Gains Report in Quicken. Because the US.

On May 2 my old problem returned - same two tax fields same repeatable behavior. Why is this important.

Mixing Pace Into Your Business Just Make Us Care For All Of Your Transactions Accountant Business Clientaccountant Audit Bookkeeping Care For All Business

Tax Planner Other Withholding Using Wrong Total Quicken

Quicken Support Phone Number 1877 980 4312 24 7 By Quicktech Solution Quicken Phone Support Accounting Software

Quicken Budgeting Tutorial For Your Personal Finances Budgeting Personal Budget Setting Up A Budget

888 846 6939 Instant Quicken Help To Fix Quicken 2018 Issues

My Roth Conversions Are Not Showing Up In Tax Schedule Report Quicken

401k Scheduled Deductions In Tax Planner Quicken

Quicken For Mac 2016 Review Un Kill Bill Pay

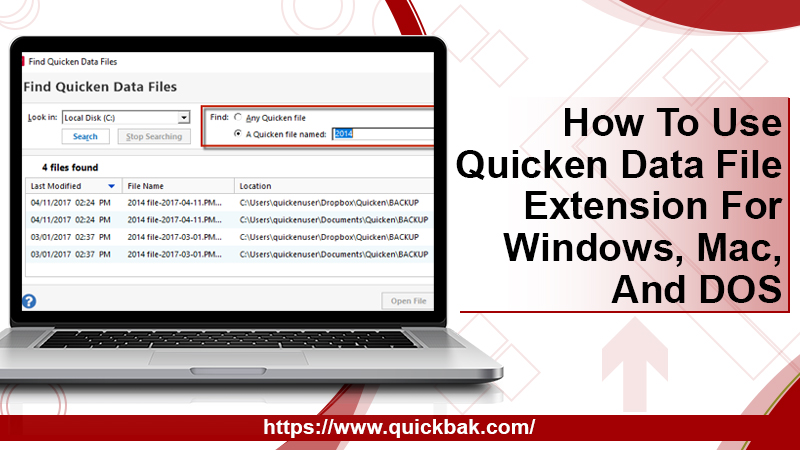

Quicken Data File Extension Get Instant Support To Open It

Tax Planner How Do I Account For The End Of Year Mutual Fund Divs Cap Gains Quicken

Quicken 2010 Review Moneyspot Org

Quicken Starter Review Top Ten Reviews

Quicken Phone Support Number By Experts Certified Accounting Experts Are Here To Help You Dial 1866 209 3656 Accounting Software Quicken Financial Information

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits